The cost of housing and education for young adults in England

Something went very wrong in the UK, and especially in England, during the 1980s, 1990s, 2000s and 2010s. Housing became too expensive for young adults to afford and then, by 2012, we made half of them take out huge debts to go to university. It’s time to fix both problems.

The housing crisis and educational malaise are linked. In Britain in 2019 a nurse has to pay back more on their student loan than a banker who is able to pay it back earlier and so pays far less interest. The nurse also has to pay a far greater share of his income in rent if he works in England near most major hospitals.

Both of these young adults will have much less disposable income in future to pay for their housing costs because they have those debts to repay, for many decades to come. They will be able to afford less in rent and will not be able to make the same mortgage payments that their parents might have been able to (as a share of their own income).

Mortgage interest rates may be much lower than in the past, but the total amount they would have to borrow would be far greater, this is because housing costs so much more. And the longer they rent, the more likely they are to have to rent for the rest of their lives.

The worst aspect of the debts now being built-up to pay for higher and further education is that for even a minority of the loans ever to be repaid in full, the UK will have to maintain the highest income inequalities in all of the EU28 states.

If, in future, income inequalities were to fall towards the European norm, then more and more current graduates will either default on their repayments in future, leave the country for a better life abroad, or fall below the threshold at which they have to repay – underfunding the entire student loan scheme.

Housing is in a crisis in the UK and education in malaise because of the gross income inequalities we currently tolerate. However, there are plans in place to remedy this. For the capping of most student loans one such plan is Jubilee 2022.

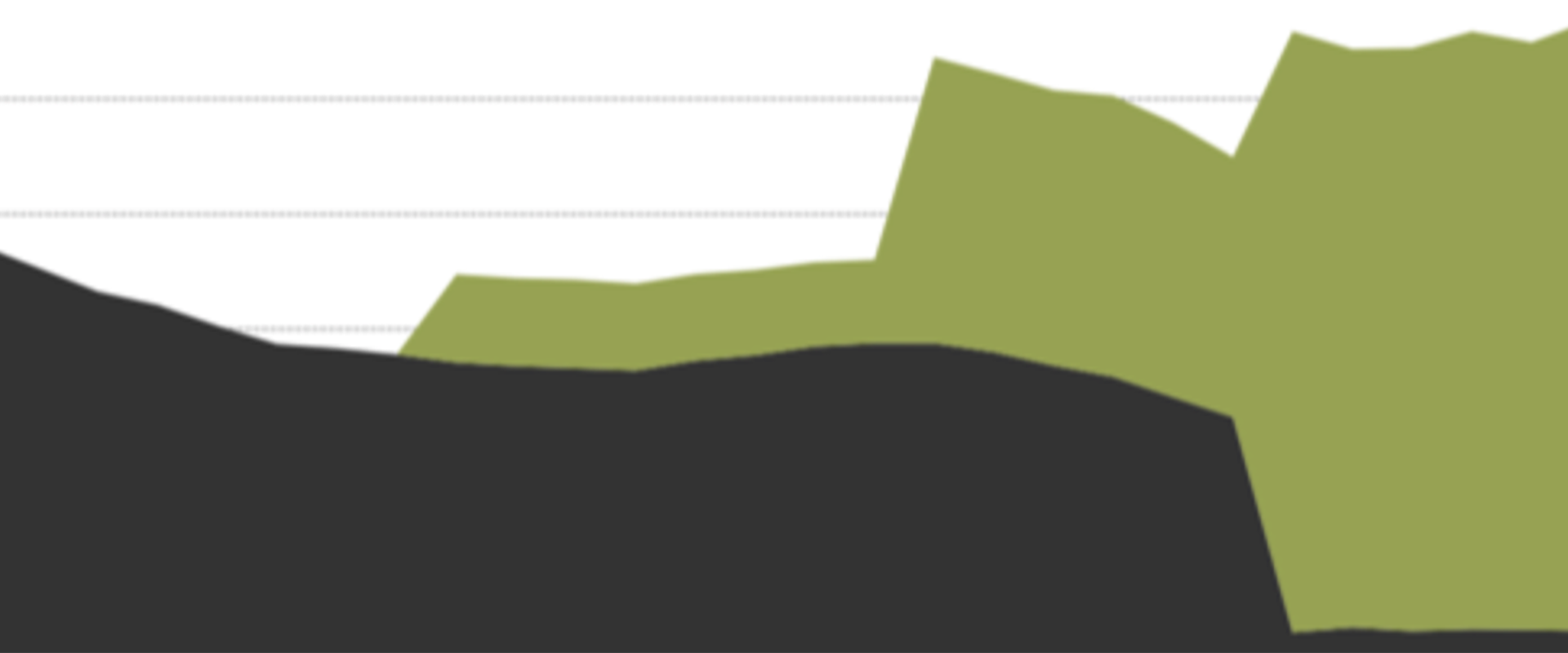

Figure 4.1, Higher Education funding in England, IFS Briefing Note BN211

Something has to give. Someone old will have to give up more because the young will not be able to afford to buy their homes in future at the prices they are trying to secure and a generation of university graduates is unlikely to swallow the idea of paying exorbitant private rents for the rest of their lives to fund the cruise ship holidays of their ever more wealthy older landlords. UK universities are now almost entirely funded by private individuals rather than the state. Those universities have – in effect – taken a very large chunk out of the future value of the British housing market.

When landlords who own many properties say that they own them to fund their private pension, ask what pension they expect their tenants to ever have. The large majority of private lets are owned by a small minority of very wealthy landlords. Changes to the law on housing are needed, to regulate rents and curtail greed, as well as the building of much more social housing.

The discussion below was recorded at the annual Bright Blue conference (a UK Liberal/Conservative think tank). It is becoming more and more obvious that the current impasse is unsustainable. Click play below to hear what solutions are being suggested and the new questions being asked.