Living in extraordinary times

Every so often a social statistic is released that confirms something extraordinary has occurred, something so strange that it cannot continue, suggesting that the trend has to change again soon.

[Original submitted text of article posted on the Telegraph Newspaper Website by Mark Fransham and Danny Dorling]

Often such statistics involve good news stories. The current fall in the infant mortality rate worldwide is so fast that it will soon have to slow down, as the rate cannot become negative. Similarly, a few years ago life expectancy in some of the most affluent parts of the UK was increasing by more than a year in a year. That was also clearly unsustainable, unless people there became immortal.

This year’s impossible-to-carry-on social statistic is found in the rise in private renting in the UK. The rise has now reached such a speed that if it were to continue rising at current rates then within ten years half of all households headed by someone aged under 55 will be renting privately. Within another ten years half of all UK households would be.

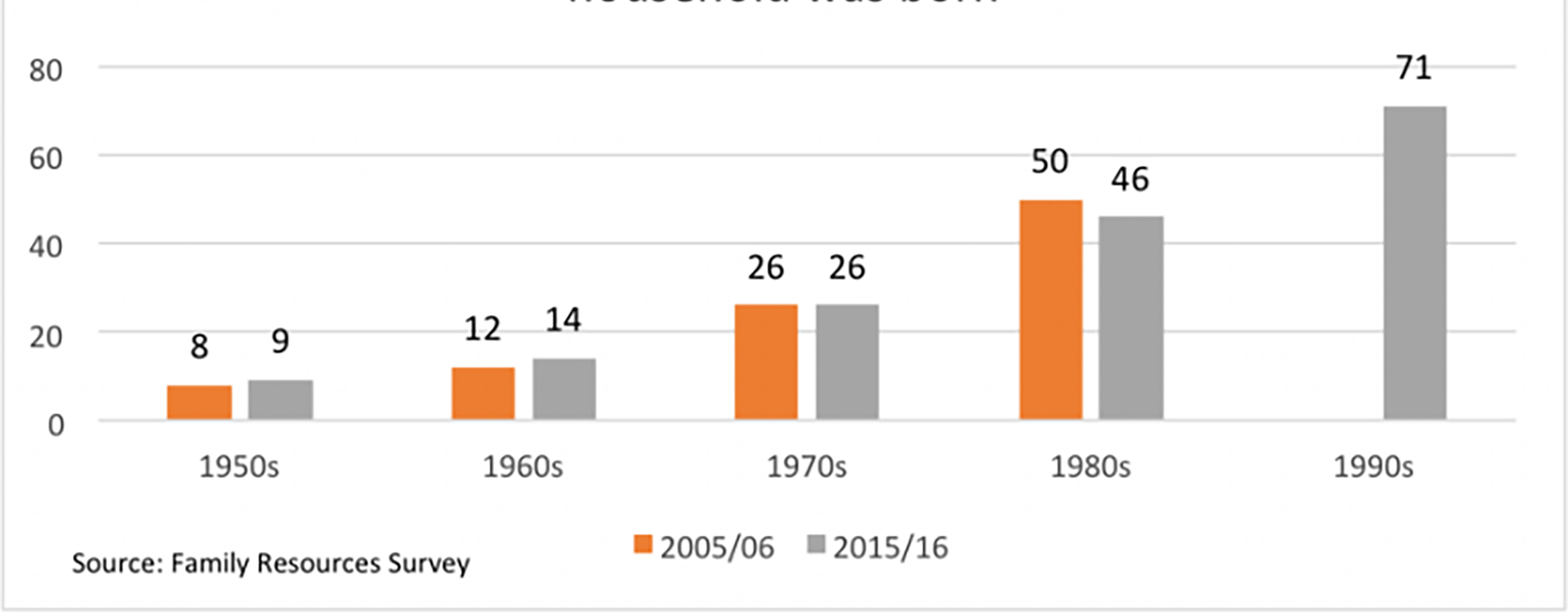

The graph shows the proportion of households born in each decade that were renting privately in 2005/6 and also ten years later (according to the most recently released data). The graph reveals that by 2015/16 71% of all households headed up by someone in their twenties or late teens was renting privately. A decade earlier that proportion had been 50%.

For people born in the 1970s, just over a quarter (26%) are now renting privately, exactly the same proportion as ten years earlier for that cohort. There appears to be no escape from ‘generation rent’ even for this older generation. What that statistic means is that the number of people in their late thirties or early forties who managed to get a mortgage in the last ten years have been cancelled out by people of the same age who had to give up buying, who split up and have rented, or who left another tenure to become a private renter.

The statistics for even older people appear to be getting even worse, unless you equate renting privately at older ages with greater freedom. For those who are now aged between 48 and 57 the proportion who head up a household that is privately renting has risen from 12% in 2005/6 to 14% in 2015/16. In short, if you were nearing middle age ten years ago and were not already on the ‘housing ladder’ then you are even less likely to be on it now.

These statistics bear witness to the end of an era – an era in which the older you got, the more likely you were to escape private renting. The trends most recently revealed by the Family Resources Survey, when compared to the same Survey data from a decade earlier, suggest that (on average) there is no longer any escape. Private landlords are buying up such a high proportion of properties that as people in the UK age their chance of not having to rent privately for another year no longer improves. The ‘housing ladder’ is becoming a fiction because, in net terms, as many people have been stepping off the ladder as have stepped on to it.

Why do we know that this cannot continue? That is because the rate of change has been so fast. For the trend to continue most people aged under 40 today should assume that given currently trends they will be renting from a private landlord for the rest of their lives. Within a decade most people aged under 50 should assume they will always rent, then most aged under 60. At the same time over 90% of people in their twenties, then over 90% in their thirties will be privately renting, and at this point the increase has to slow down because it simply is not possible that more than 100% of an age group are in any one tenure.

So can mass private renting be sold to the British? The argument for increasing private renting in the UK was that the rate was below what was usual in many other European countries and having a population that can more easily migrate is good for the economy. In the rest of Europe people have a greater choice over whether to rent or buy. Those who rent have much better security of tenure and enjoy lower rents for higher quality properties. Those who buy elsewhere in Europe do not expect to make the financial gains that homeowners and landlords in the UK have made in recent decades.

As long as house prices continue to rise much faster than wages in the UK the trends shown in the graph above can be expected to continue, regardless of Brexit. The fact that we cannot sensibly expect those trends to continue as they have for much longer may tell us many things. Not least over what we ought to expect to happen to house prices in future. They can only keep rising if we keep moving this quickly towards a mass private renting future.

Read version published on the Telegraph Website April 8th 2017