Renting your way to poverty: welcome to the future of housing

The housing crisis is already out of control, and no one in politics wants to help

George Osborne’s latest budget continued the trend of all his other budgets: introduce new measures that will further inflate house prices. This time it was “help to buy” ISA’s.

George is on a roll, and it’s not clear whether he realises where this price-hiking frenzy might end.

During 2013 housing prices in London rose by around £40,000 for an average flat or house that was sold compared to the previous year. This brought the cost of a typical London home sold on the market up to just above £475,000. This rate of increase continued through 2014.

By 2015 average London prices were over £500,000.

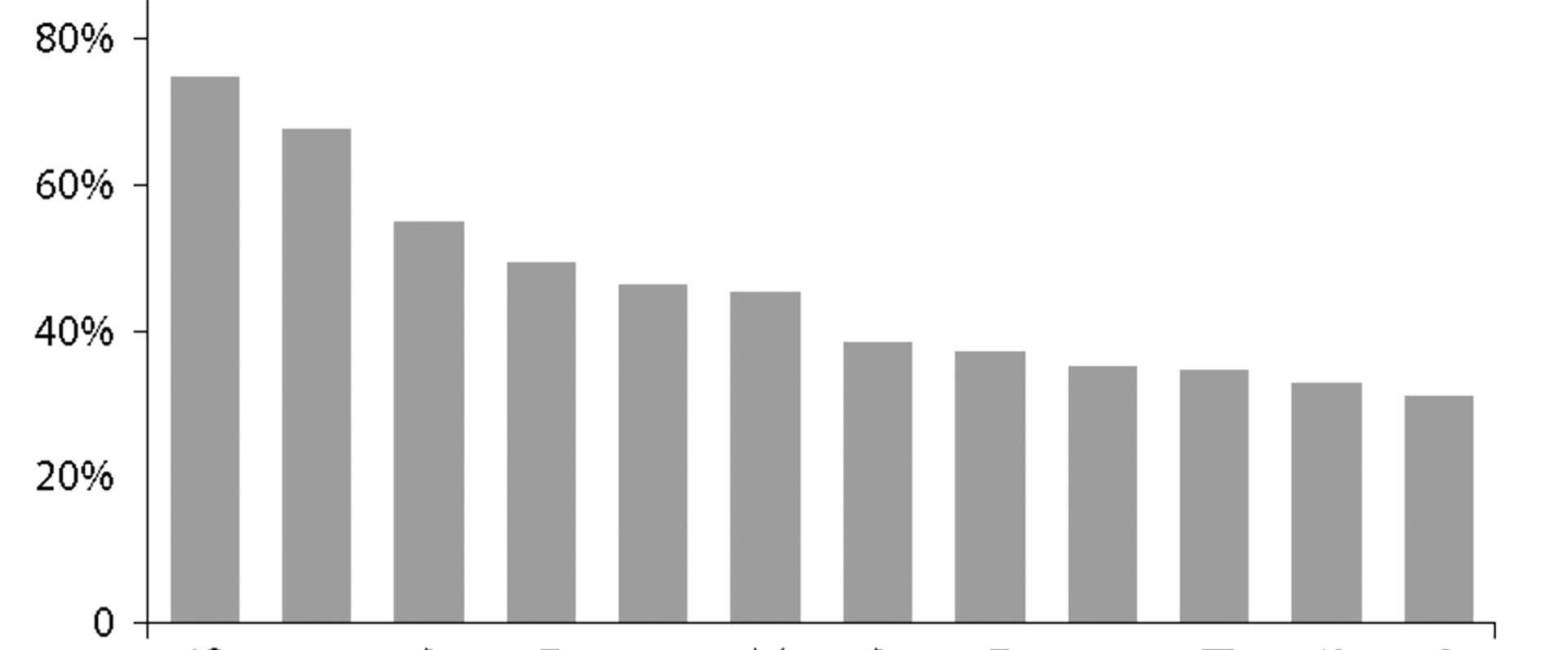

Fewer and fewer people are able to get a mortgage. In the UK stricter tests have been introduced to try to prevent banks and building societies lending as recklessly as they did before. There have been repeated warnings to borrowers that at some point interest rates will have to rise. Up is the only direction in which they can go. The US Federal Reserve is now hinting that they will raise interest rates soon.

At least a third of mortgagees would struggle if interest rates were to rise by just a couple of percentage points. The further house prices in the South of England climb, the greater that proportion will grow as new entrants become more stretched. People who are a safe bet at one point in time can easily lose their jobs, split up or become ill. Add a slight rise in mortgage interest rates and anyone already struggling to pay the bills quickly gets into arrears.

Prices have risen because the government has been trying to get them to rise. At the end of 2014 the campaigning organisation Priced Out calculated that the government-sponsored Help to Buy programme had helped raise average prices by £46,000 in 18 months – or 27 per cent – resulting in an additional 258,000 renters being priced-out of buying a home as compared to the 31,000 buyers helped by the scheme. Some 3.5 million people who would have normally been able to buy a home are now trapped in private renting.

Read the full article by Danny Dorling on the Telegraph website or in Danny’s web archive.